Smart Document Processing with InsurAI

Written by Syed Usman Chishti

Subject Matter Expert

September 8, 2023

In the fast-paced world of the insurance industry, efficiency and accuracy are paramount. Traditional document processing methods have often proven to be slow and error-prone, leading to inefficiencies and missed critical information.

In this blog, we’ll delve deeper into how InsurAI is poised to transform the insurance sector and how Royal Cyber is ready to tailor this revolutionary technology to your enterprise’s unique needs with Generative AI.

The Challenge: Complex Document Processing

Insurance companies encounter a myriad of documents daily, spanning customer emails, demand letters, assorted forms, and intricate call transcriptions. Extracting valuable insights and ensuring precise categorization from this diverse document landscape can be formidable.

However, the solution is at hand with InsurAI’s cutting-edge AI technology. In this intricate web of insurance-related data, InsurAI emerges as the guiding light, offering efficient and accurate document processing solutions that redefine industry standards.

The Solution: InsurAI's Technical Prowess

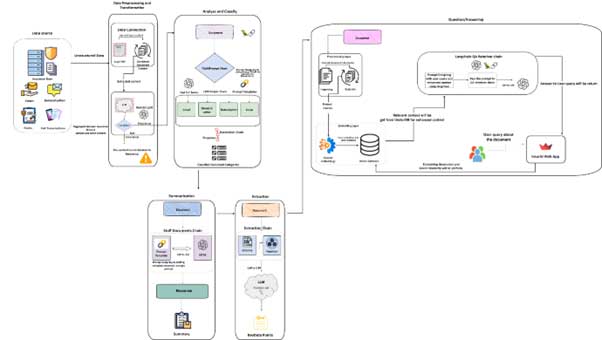

At the core of InsurAI’s technical prowess lies Lang Chain, an orchestration tool that seamlessly integrates with OpenAI models and FAISS. Lang Chain is the conductor of this innovative symphony, orchestrating the flow of data, analysis, and insights within the system.

With InsurAI, you can swiftly handle, categorize, and extract crucial details from various documents. This includes customer emails, demand letters, forms, and the ability to facilitate Q/A directly from the given content, ensuring comprehensive insights from customer data.

Business Benefits of using InsurAI

The advantages of adopting InsurAI for your insurance operations are significant. Some of these are:

- Operational Efficiency: Realize up to a 70% reduction in document processing time, enabling faster response to customer needs.

- Enhanced Accuracy: Achieve over 95% accuracy in document categorization and data extraction, reducing errors and improving decision-making.

- Cost Efficiency: Streamline operations and reduce costs by up to 50% by minimizing reliance on manual, error-prone methods.

- Improved Customer Service: Enhance customer response times by 60%, improving customer satisfaction and loyalty.

High-Level Architecture

It’s essential to understand that InsurAI isn’t an off-the-shelf product. It’s a testament to what’s achievable when you combine the power of Lang Chain, OpenAI models, and FAISS. It’s a glimpse into how generative AI can redefine roles in the insurance sector, making processes more innovative and efficient.

We used modern data technology to build our solution, including Azure Event Hubs, Databricks, Power BI, and Azure Stream Analytics. The constructed ETL (extract, transform, and load) pipeline comprised two parts: one pipeline handled batch storage, whereas the other pipeline was designed to carry streaming data. It was also arranged so that the continuous data stream could be visualized in real-time.

The Future of InsurAI: Tailored Solutions by Royal Cyber

While InsurAI showcases its transformative capabilities, it’s just the beginning. Imagine a tailored solution exclusively crafted for your insurance enterprise. Royal Cyber is ready to bring this vision to life.

We aim to create an integrated platform that synchronizes effortlessly with your operations, whether as a stand-alone API or in harmonious collaboration with a digital co-worker. We envision reshaping the insurance paradigm, ensuring meticulous data management within a custom-built framework for the industry.

InsurAI is not just a tool; it’s a game-changer. It’s the future of intelligent document processing and Q&A in the insurance industry, and it’s ready to empower your enterprise like never before. Get in touch with us to discuss how InsurAI can reshape your operations.